In the ever-evolving landscape of financial institutions, the demand for efficient, secure, and scalable technologies is more critical than ever. Among the various innovations driving efficiency, On-Prem Speech to text for financial institution stand out, providing financial institutions with the ability to process and transcribe spoken language into text in real time. This article, AT Technology and Consultancy Joint Stock Company (ATTECHSOFT) will explore the significance of this software for financial institutions, including its key features, applications, and how it can reshape the future of finance.

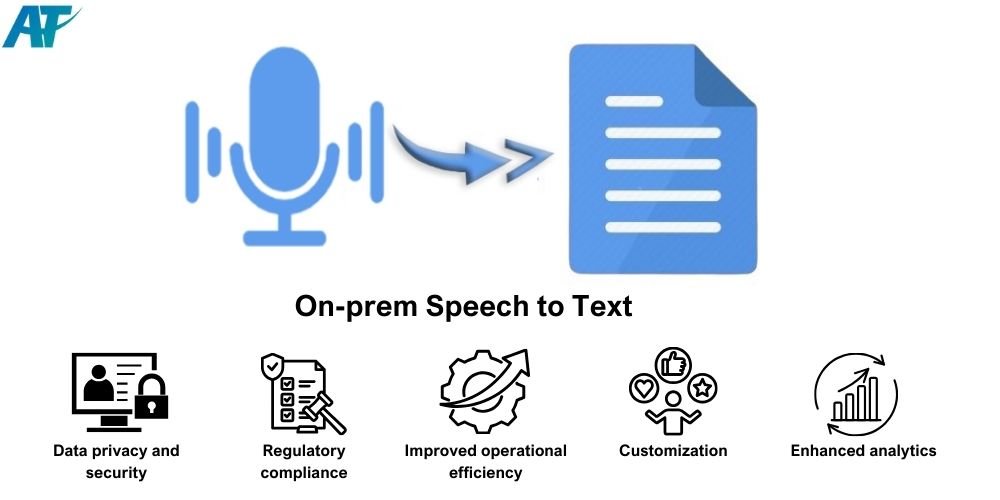

The advantage of on-premise voice transcription

On-prem speech-to-text solutions provide unmatched control and security over sensitive data. By keeping data processing within the institution’s infrastructure, these systems eliminate risks associated with data breaches and third-party access. Compliance with stringent regulations, or industry-specific financial laws becomes more manageable with on-prem setups. Additionally, they offer the flexibility to customize features, ensuring they align with the unique operational needs of financial institutions. Moreover, on-prem solutions provide consistent performance without dependence on internet connectivity, which is crucial for ensuring seamless operations.

Practical applications of on-prem speech to text for financial institution

On-prem speech-to-text technology has diverse applications in the financial industry. For example, customer service optimization can be achieved by transcribing customer calls to analyze patterns, improve service quality, and ensure compliance with regulatory requirements. Real-time transcription of conversations can also aid in fraud detection when paired with AI algorithms to identify potential fraudulent activity. Additionally, meeting documentation becomes more efficient as board meetings, strategy discussions, and compliance reviews are transcribed accurately, ensuring accountability and creating reliable records. Furthermore, on-prem systems enhance accessibility by providing live captions for employees or customers with hearing impairments.

Choosing the most effective on-premise voice to text

Selecting the right on-prem speech-to-text solution requires careful consideration of several factors. Accuracy and language support are paramount; financial institutions should seek solutions with high transcription accuracy, particularly for financial jargon and support for multiple languages. Scalability is also essential to handle growing volumes of audio data as the institution expands. Integration capabilities is also significant, with a preference for systems that seamlessly integrate with existing CRM, compliance, and analytics tools. Vendor reputation and support are critical; institutions should choose providers with a proven track record in the financial sector and reliable customer support. Finally, cost and ROI should be evaluated, balancing the initial investment against long-term savings from enhanced efficiency, compliance, and customer satisfaction.

Don’t miss these related topics: Speech to text software

Conclusion

On-premise speech to text technology is proving to be a valuable asset for financial institutions, enabling them to improve operational efficiency, enhance customer service, and maintain strict control over sensitive data. By offering real-time transcription, high accuracy, and the ability to integrate with existing systems, on-prem STT solutions empower financial institutions to streamline their workflows, comply with regulatory requirements, and provide a better overall experience for both clients and employees.

Contact us to arrange a demonstration:

Email: sales@attechsoft.com

Website: https://attechsoft.com/